Neural Price Forecasting System

Multi-Model Time Series Prediction with Automated Hyperparameter Tuning

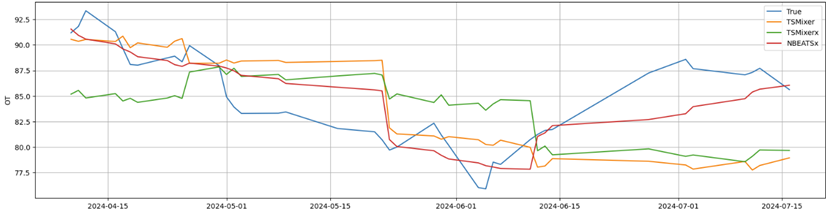

A machine learning application for forecasting commodity and financial asset prices using state-of-the-art neural time series models with automated hyperparameter optimization. The system supports both univariate and multivariate forecasting with integrated technical analysis and calendar feature engineering.

Architecture

- Modular ML pipeline with separation of data ingestion, transformation, and prediction

- Automated experiment tracking with model versioning

- PyTorch Lightning for distributed training orchestration

- Optuna TPE sampler for hyperparameter optimization

Key Features

Neural Forecasting Models: AutoNHITS with hierarchical interpolation, AutoTSMixerx with exogenous variable support, AutoiTransformer for multivariate analysis, and AutoTSMixer for temporal pattern recognition.

Automated Optimization: Hyperparameter search with configurable search spaces, 10 trials per model, early stopping based on validation loss (patience: 5), and MAE loss function for robust predictions.

Feature Engineering: Calendar features (day_of_week, is_weekend, month, quarter, year, is_holiday), standard scaling for univariate data, robust scaling for multivariate data, and automatic train/validation/test splits.

Technical Analysis Integration: Moving averages, RSI with configurable periods, Bollinger Bands, MACD with signal line, Ultimate Oscillator, and ADX with directional movement indicators using pandas_ta.

Training Infrastructure: PyTorch Lightning with CSV logging, maximum 1000 training steps, validation checks every 50 steps, and organized artifact storage with model checkpoints.

Technical Stack

- NeuralForecast for time series models

- Optuna for hyperparameter optimization

- PyTorch Lightning for training orchestration

- pandas_ta for technical analysis indicators

- scikit-learn for preprocessing pipelines

Use Cases

- Crude oil price forecasting (Brent futures)

- Multi-asset price prediction with exogenous variables

- Integration of Gas prices, DXY index, and Brent futures data