Recon-AI

Enterprise-Grade Bank Reconciliation Engine with Tri-Layer AI Processing

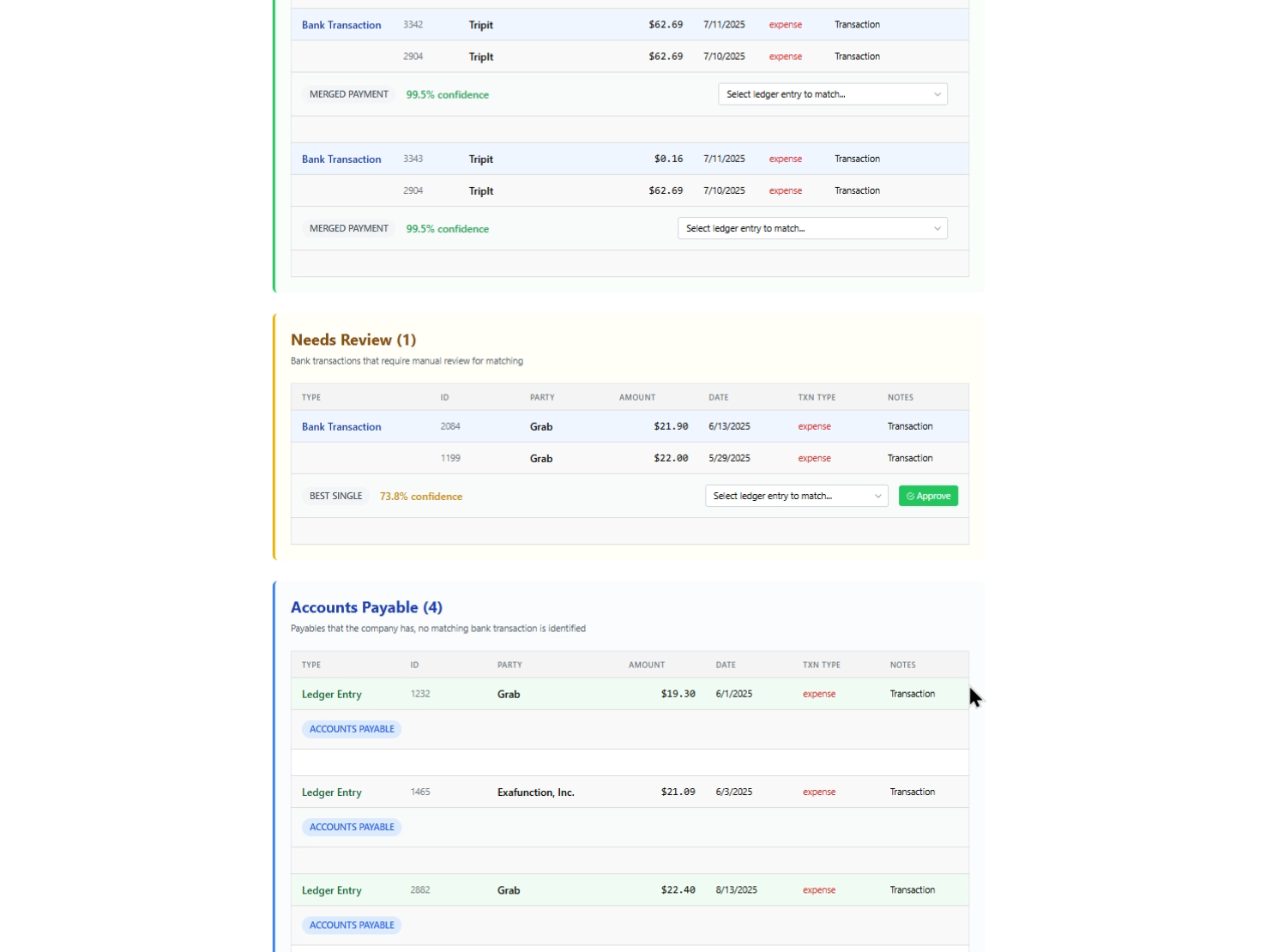

A financial reconciliation platform combining mathematical algorithms with AI to match bank transactions with ledger entries. The system uses a tri-layer approach: proprietary weighted scoring for initial matching, followed by GPT-4 for complex cases requiring contextual understanding, and a conflict resolution layer for single vs. split payment scenarios.

Technical Stack

- Backend: FastAPI with async/await patterns, async AI API calls

- Vector Store: ChromaDB with text-embedding-3-large (1024 dimensions)

- Database: PostgreSQL Cloud SQL (production), SQLite (development)

- Cache: Async SQLite with WAL mode, 10-minute TTL

- Infrastructure: Google Cloud Run with auto-scaling

Key Features

Split Payment Detection: Many-to-many matching for complex scenarios (one bank transaction to multiple ledger entries, or vice versa)

Intelligent Batching: Concurrent processing with controlled parallelism, reducing LLM API costs by 80% while maintaining accuracy

Conflict Resolution: LLM-arbitrated matching with evidence-based decisions and complete audit trails for compliance

Performance Optimization: Memory-efficient processing handles 100k+ transactions with parallel execution and multi-level caching

Performance Metrics

- 95% overall reconciliation accuracy

- 80% reduction in LLM API costs through intelligent batching

- 1,000 transactions/minute processing speed

- 100+ concurrent reconciliation jobs supported

- Sub-512MB memory usage for typical scenarios